And voters approve a tax increase in Mississippi, as they do in virtually every poll taken on the issue regardless of the state.

Yet, that doesn’t mean raising cigarette taxes to cover budget shortfalls is good public policy. Quite the opposite, excise taxes on cigarettes are one of the least stable parts of a state budget and will likely only leave lawmakers looking for other solutions in a few years.

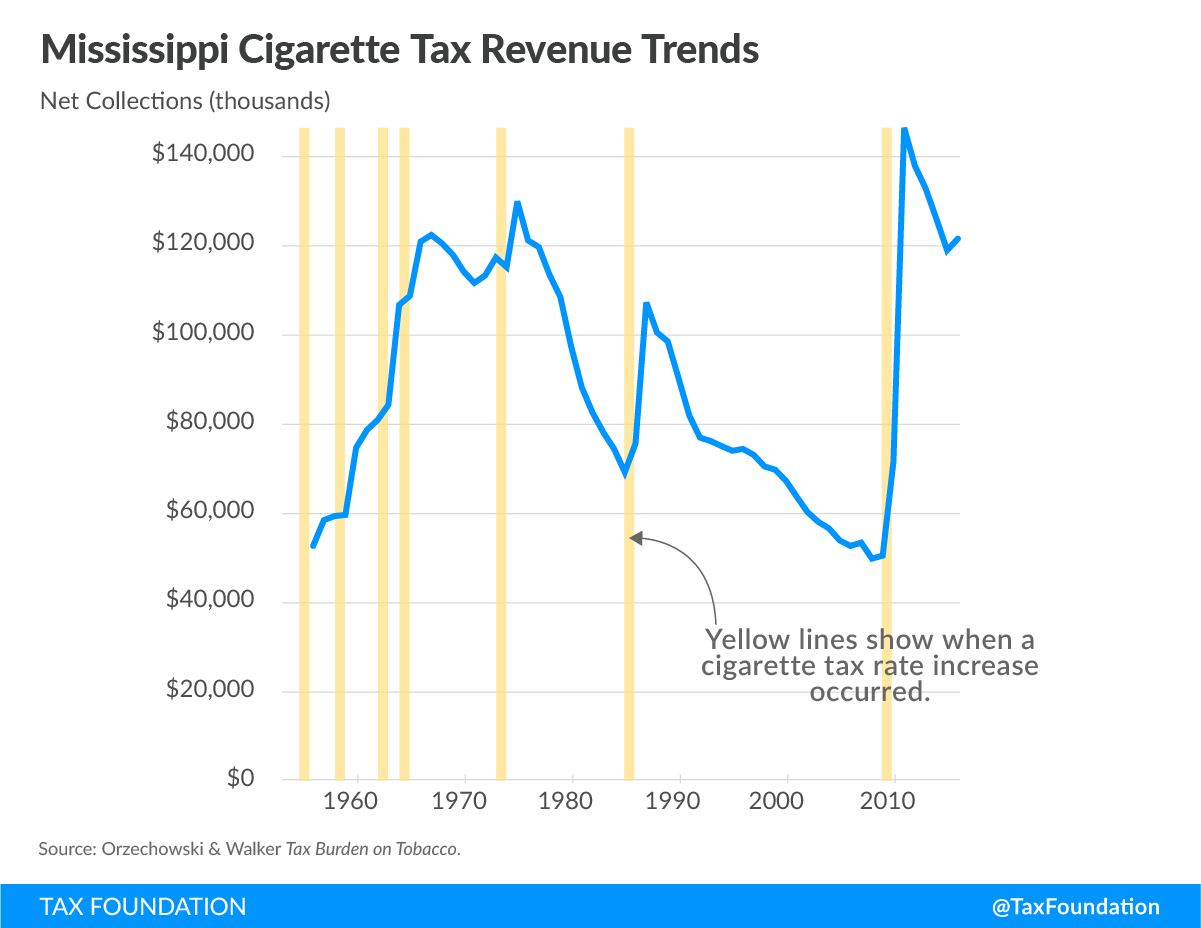

As taxes on cigarettes are constantly being raised, we have a great deal of data on this subject. What we experience is an immediate bump in revenue, followed by a falloff in collection in future years. This happened the previous three times cigarette taxes have been raised in Mississippi; 1973, 1985, and 2009.

As you can see, the state noticed an immediate uptick followed by a decrease. Today, the state is collecting the same tax revenue (adjusted for inflation) on cigarettes as it was in 1975. This, despite the fact that taxes have increased by 518 percent during this time period.

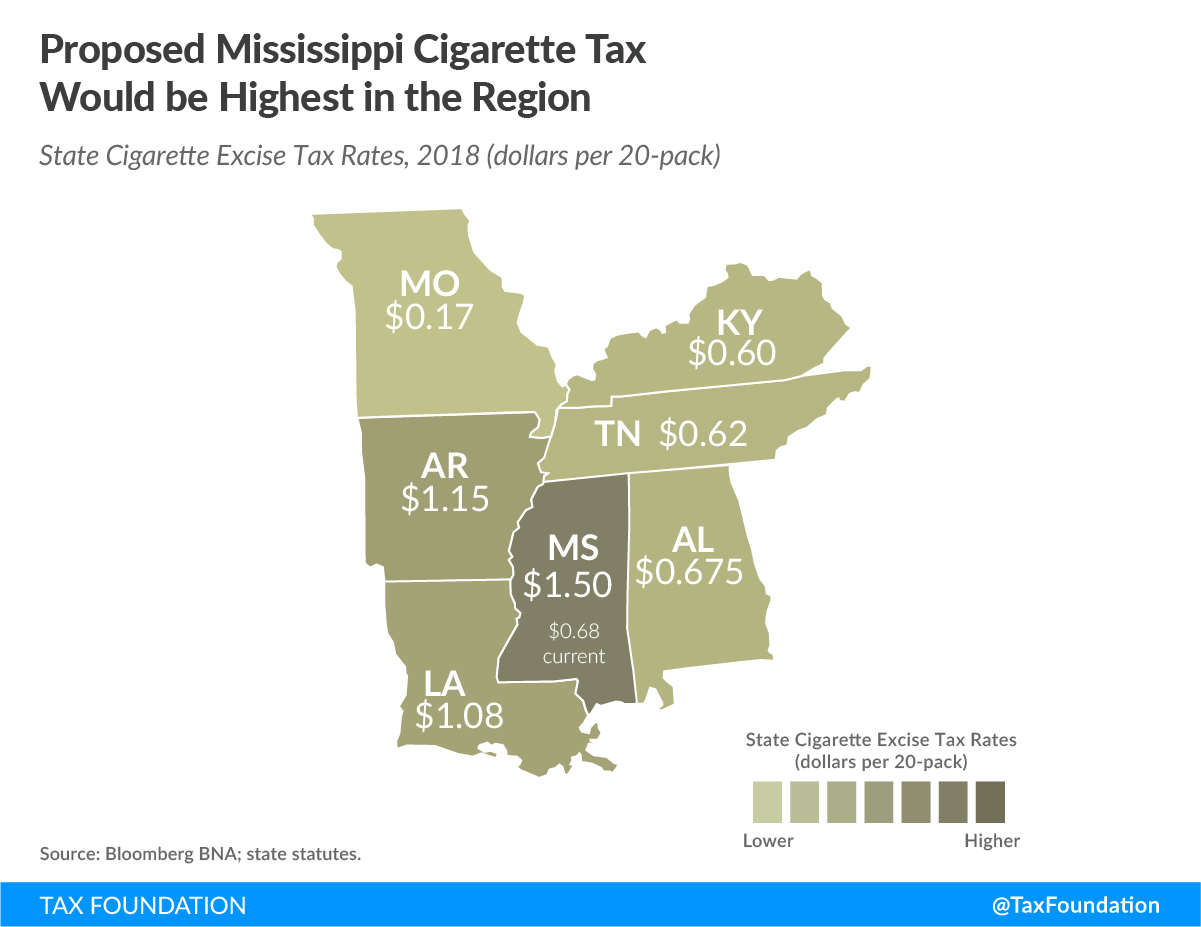

A second thing happens when a state adopts the highest cigarette tax rates in their region: people look elsewhere for cigarettes. The proposed $1.50 increase (to $2.18) that some are pursuing would place Mississippi’s tax rate at least 90 percent higher than Arkansas and Louisiana and more than 200 percent above that in Tennessee and Alabama. And as a result, even less revenue is collected.

Cigarette usage has been declining since the 1960s and that trend is not slowing, even if Mississippi is above the national average. If the goal of health advocates is to see that number reach zero, it will happen because of continued education, not taxes.

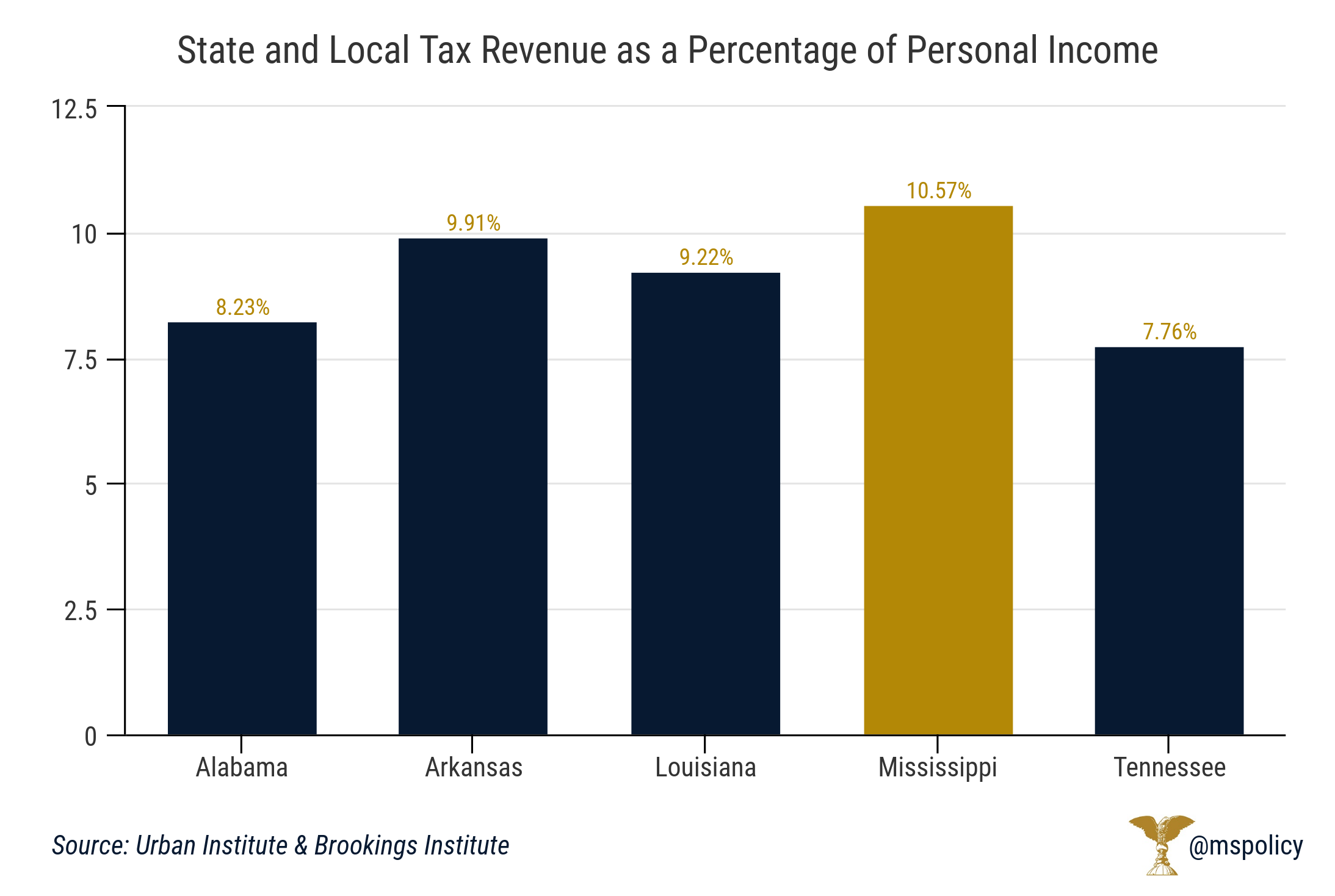

Cigarette taxes are easy. But the comprehensive tax reform that Mississippi needs is far more complex. The state has one of the highest total tax rates as a percentage of personal income in the Southeast. While Mississippi’s local and state tax revenue rate is 10.57 percent, the four neighboring states range from 7.76 percent to 9.91 percent.

And unfortunately for Mississippi, Americans, and their wealth, are moving to low tax states. So what can we do in Mississippi? We can follow the lead of high-growth, low-tax states in the Southeast that have lower taxes, lighter licensure and regulatory burdens, and a smaller government.