The Public Employees' Retirement System of Mississippi — which serves most state, county and municipal employees — earned $2.385 billion in investment returns in fiscal 2018, a 9.48 percent rate of return, after earning $3.4 billion or a 14.96 percent rate of return in 2017, according to its comprehensive financial report released on December 18

The plan expects an annual return on its investments of 7.75 percent.

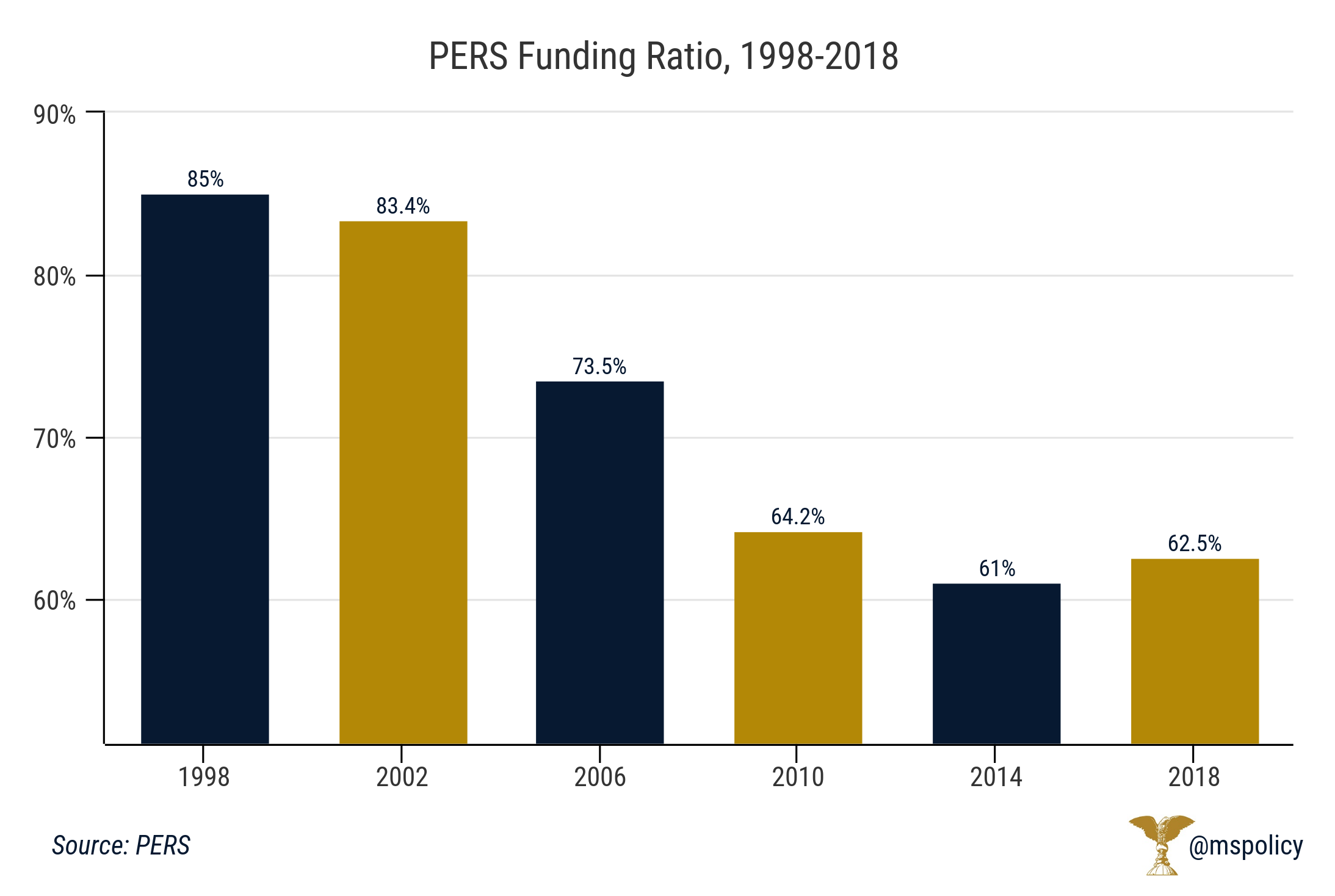

The funding ratio, which is defined as the share of future obligations covered by current assets, also ticked upward for the second consecutive year, improved from 61 percent in 2017 to 62.5 percent. As recently as 2001, the plan was 87.5 percent funded.

The funding ratio is a useful measure for gauging the health of a pension fund, as PERS was 85 percent funded in 1998.

Despite the second year of big returns on its investments, the plan’s unfunded liability remained the same at $16.6 billion. To fill this gap would require 2.76 years of all general fund tax revenue.

Along with the annual report from PERS, there are independent organizations that also track state administered pension plans. According to Pew, Mississippi has a funding gap of $18 billion. According to their report, Mississippi taxpayers would need to contribute an additional 4.6 percent to fund the system. The American Legislative Exchange Council (ALEC) has a bleaker picture for the retirement system, showing just 24 percent of promises currently funded and unfunded liabilities of over $80 billion.

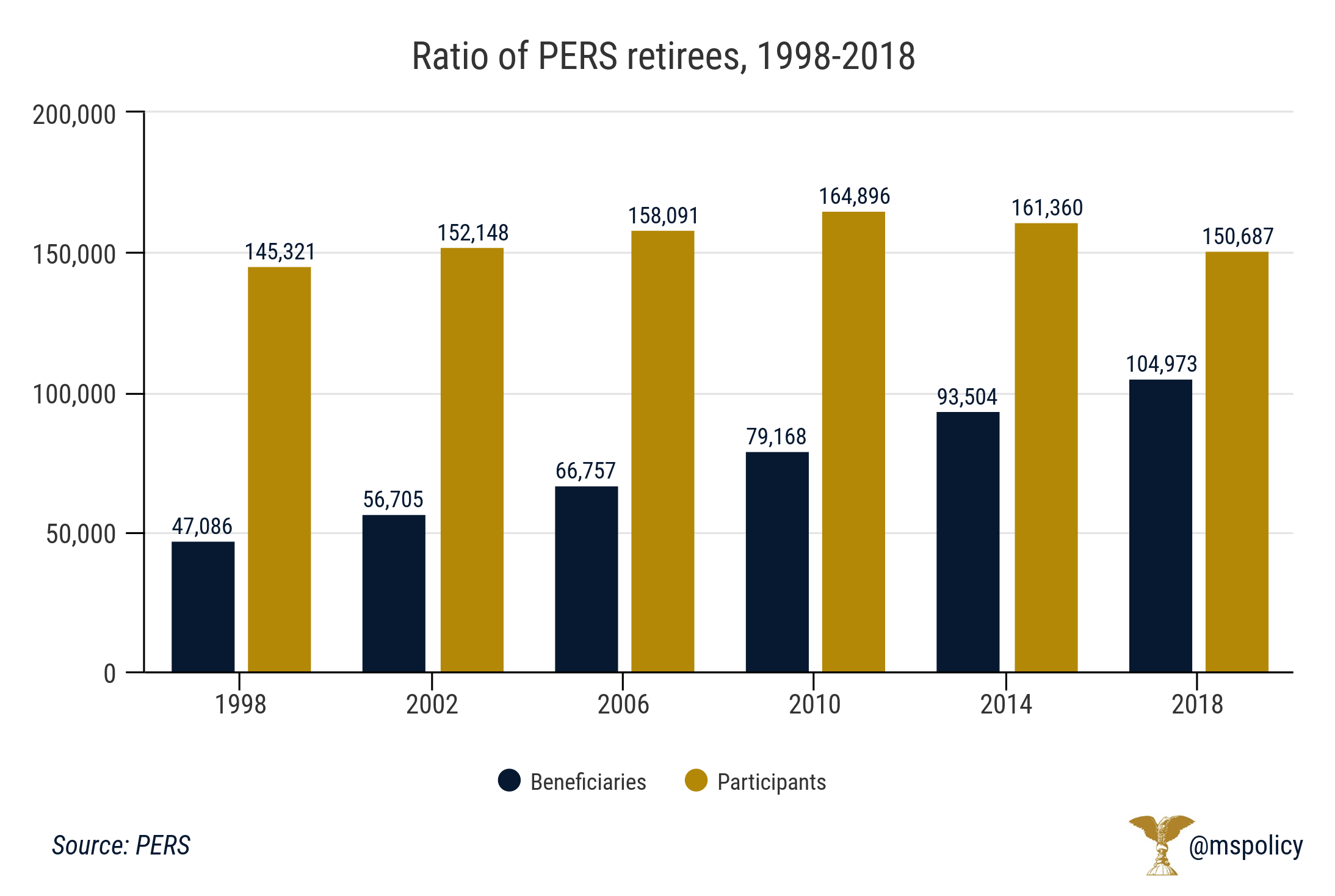

The reason is the increasing number of retirees supported by a shrinking number of contributing employees. Benefit payments added up to $2.6 billion, an increase of 5.3 percent over 2017, as the number of retirees increased from 102,260 to 104,973.

The number of contributing employees dropped from 152,382 in 2017 to 150,687. The amount of employer (taxpayer) and employee contributions added up to $1.6 billion, about the same as the year before.

The PERS board voted this summer to increase the taxpayer contributions from 15.75 percent of payroll to 17.4 percent. The legislature will have to appropriate $75 million or more for the employer contribution for state employees, while the increase for municipal and county employees could be on the hook for $25 million or more.

The trend of increasing numbers of retirees and decreasing numbers of contributing employees will continue for the foreseeable future thanks to unfavorable demographics.

The average age of the plan's members is 44.8, up slightly from last year (44.7) and members with at least 15 years of service represent 27.9 percent of all state and municipal employees in the PERS system. In 1999, the average age of PERS members was 42.4.

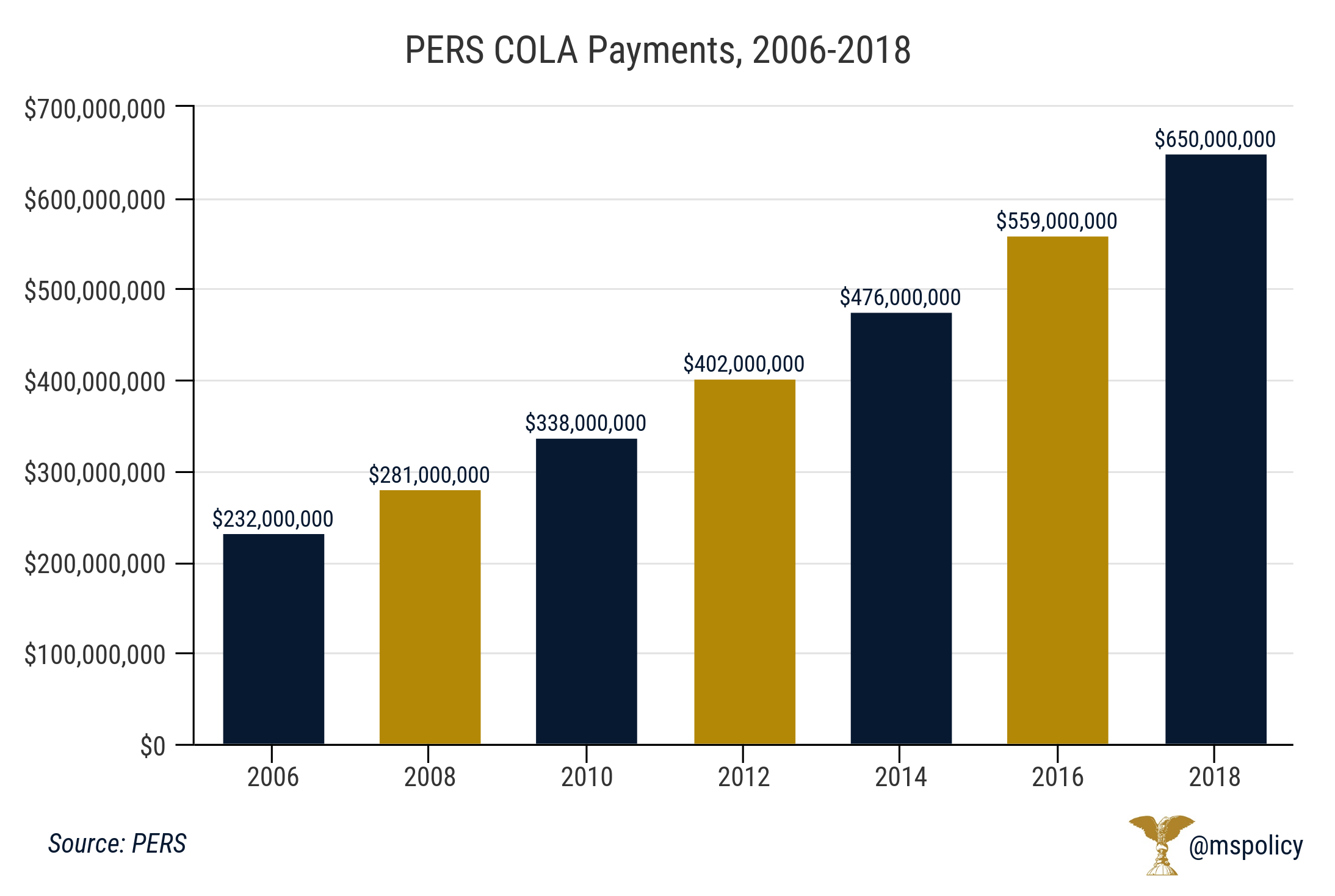

With more retirees, the plan’s payments for its cost of living increase or COLA added up to $650 million, a 7.8 increase over last year’s COLA payments of $603 million.

The fund provides a cost of living adjustment that amounts to three percent of the annual retirement allowance for each full fiscal year of retirement until the retired member reaches age 60.

From that point, the three percent rate is compounded for each fiscal year. Since many retirees and beneficiaries choose to receive it as a lump sum at the end of the year, the benefit is known as the 13th check.

Mississippi’s problems aren’t happening in a vacuum. According to the non-partisan Tax Foundation, Mississippi’s funding ratio of 58 percent in 2016 ranked 38thnationally and more than half of all states have pension funds that are less than two-thirds funded.