Senate Bill 2603, which Gov. Phil Bryant signed in April, will bring back the non-resident payroll portion of the incentives program. This allows for a 25 percent rebate on payroll paid to cast and crew members who are not Mississippi residents. It expired in 2017 and the Senate had refused to consider it. Until this year.

Two other incentive programs have remained on the books. One is the Mississippi Investment Rebate, which offers a 25 percent rebate on purchases from state vendors and companies. The other is the Resident Payroll Rebate, which offers a 30 percent cash rebate on payroll paid to resident cast and crew members.

Film production companies, naturally, are excited. After all, they are the only winners in the race to the bottom known as film incentives.

“That bill effectively makes Mississippi as competitive as virtually any other Southern state from a production perspective in terms of movie producers trying to find places that they can most affordably come to make movies,” said Thor Juell, vice president of Village Studios and Dunleith Studios. “That is a big deal in terms of our ability to drive the economy of production and movie film making to Mississippi, and more specifically to Natchez. That is a big deal and that is effectively why I am here.

“I had previously been working in Louisiana,” Juell added, “and Louisiana has obviously had a long history of tax incentives there that have made them extremely competitive, and they’ve seen massive spikes in jobs and just the general outlying economic activity related to all the impending pieces. Mississippi, in my opinion, is even better.”

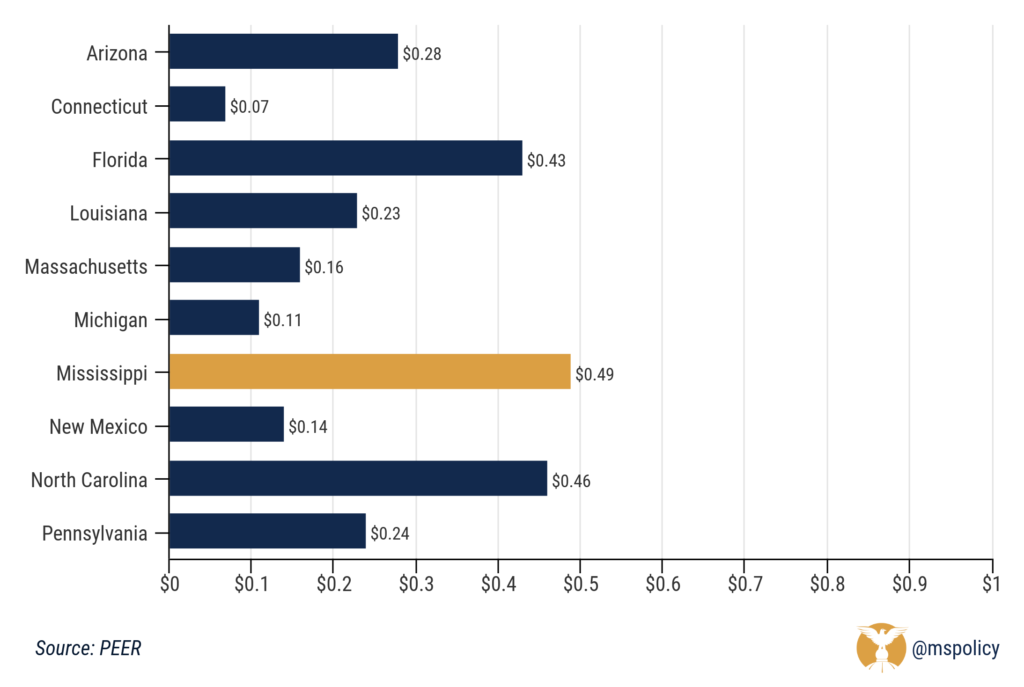

A 2015 PEER report shows taxpayers receive just 49 cents for every dollar invested in the program. That means that for every dollar the state gives to production companies, we see just 49 cents in return. If you or I were receiving that return on our personal investments, we would fire our financial advisor. Of course, no one spends his or her own money as carefully as the person to whom that money belongs.

For those looking at a bright side, we are actually “doing better” than many other states. This includes our neighbors in Louisiana, who recover only 14 cents on the dollar. They also have one of the most generous programs in the country; it was unlimited until lawmakers capped it a couple years ago. (Other reports show the Pelican State recovering 23 cents on the dollar, but either way it’s a terrible investment.)

Beyond Mississippi and Louisiana, film incentives are a poor investment throughout the country. Numerous studies have been conducted on film incentives. All sobering for those worried about taxpayer protection. Here is a review of the return per tax dollar given, courtesy of the PEER report.

That is why the number of states offering film incentives is diminishing. Not in Mississippi though.

No one can blame Juell or anyone else in the film industry for wanting or taking advantage of incentives. They are in business to make money. Yet, the state shouldn’t allow them to do so at the expense of taxpayers. Rather, the state should be working to reduce the tax burden on all companies, regardless of whether or not they have lobbyists in Jackson.