In 2019, Americans will pay $3.4 trillion in federal taxes, according to the Tax Foundation, and $1.8 trillion in state and local taxes. Income taxes, federal, state, and local, take the longest to pay, followed by payroll taxes, sales and excise taxes, and property taxes.

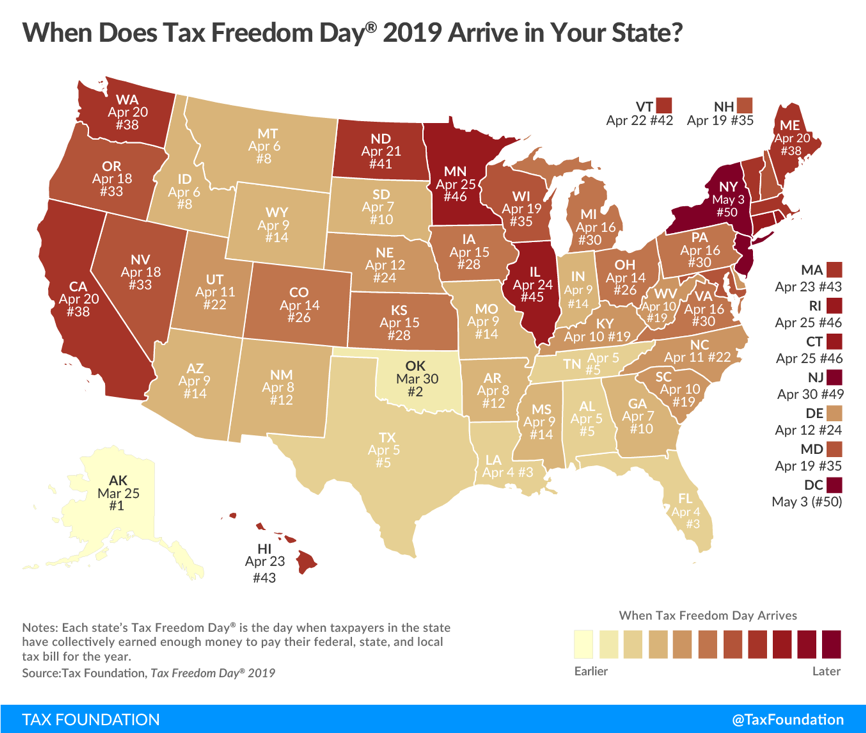

While Tax Freedom Day came before February 1 one hundred years ago before steadily moving later in the year throughout the 20th century, it has been moving in the right direction over the past few years. It was April 24 in 2015.

And on another bright side for Mississippians, we have actually been free since last week. New Yorkers, on the other hand, won’t be free until May 3.

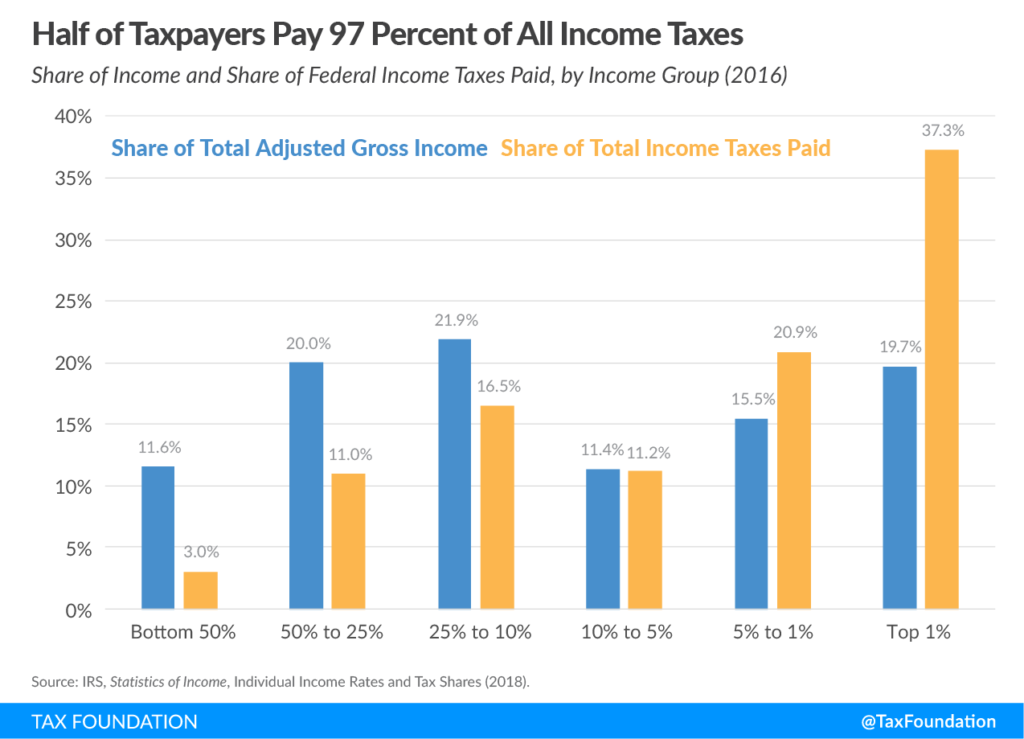

Who pays most of the taxes in America? Though it makes a good talking point, the “1 percent,” or the rich in our country, don’t get by with paying little to no taxes while the working man or woman has to foot the bill for everything. Higher income earners don’t pay lower rates as some like to claim.

These comments might win you the Democratic nomination for president, but we can look at the actual data provided by the federal government and see the true story.

In 2016, the top one percent of income earners paid 37 percent of federal income taxes despite earning less than 20 percent of the total adjusted gross income in the country, and, obviously, being just one percent of earners. The top one percent also paid a federal tax income rate of 26.9 percent.

Ninety-seven percent of income taxes were paid by just half of all taxpayers. Meaning the bottom 50 percent of earners paid just three percent of total income taxes. They also had the lowest tax rate of 3.7 percent.

That is because America has a very progressive tax structure. The more you make, you don’t just pay more in taxes proportional to your earnings, you also pay a higher percentage as a reward for your hard work.

So celebrate your Tax Freedom Day, maybe you can go and get a drink, and don’t worry about that 7 percent sales tax and the 1-3 percent local sales on top of that.