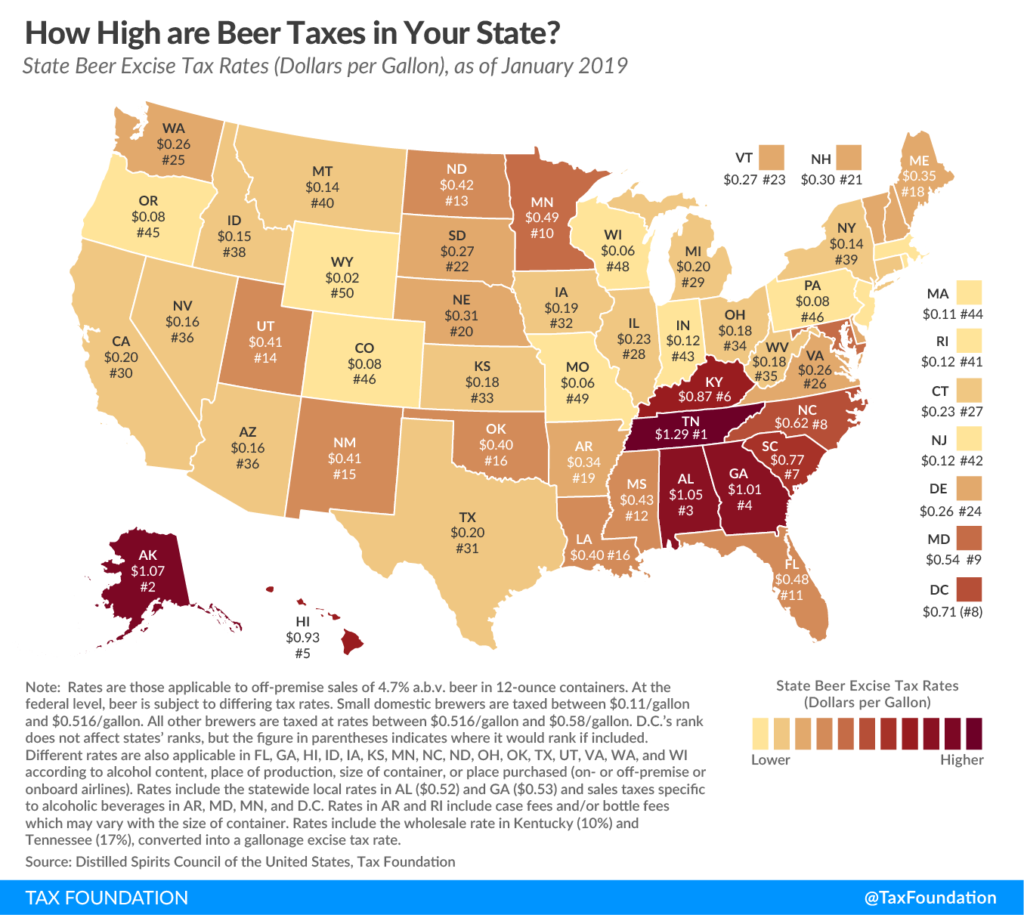

According to the Tax Foundation, Mississippians pay a beer excise tax of $0.43 per gallon. This is the 12th highest rate in the country. Mississippi just looks better than many other Southern states, who have the highest rates in the country.

Tennessee has the highest tax rate at $1.29, Alabama is third at $1.05, Georgia is fourth at $1.01, and Kentucky is sixth at $0.87. Wyoming has the lowest rates in the country at just $0.02.

In Mississippi, like most states, the excise tax is paid by wholesalers on shipments received in the state. That mean the person buying the beer doesn’t actually see it when they checkout. Rather, you will just see applicable sales taxes. But whether you can see it or not, the wholesaler just passes the costs on to the consumer. Thereby, raising the cost for the person purchasing the beer.

But the high taxes are just another example of our modern laws governing the control of alcohol, and continue a long tradition of excess government control.

We have over empowered individual counties to define their own laws, and in so doing have created a chaotic state of regulation, difficult to understand by the average residential citizen, let alone internal and external businesses hoping to sell.

Furthermore, the state has retained an egregious amount of control of the distribution process. Mississippi has decided that, rather than allow private businesses to control the market, it will run a large warehouse in the central part of the state which will have a complete monopoly over the distribution of all spirits and wines.

As the Department of Revenue states on its own site, “the ABC imports, stores, and sells 2,850,000 cases of spirits and wines annually from its 211,000 square foot warehouse located in South Madison County Industrial Park.”

This warehouse consistently operates at capacity, and government leaders are considering a $35 million expansion. Perhaps our politicians ought to consider giving the free market a chance?

There is no reason that our government should be so deeply involved in controlling the distribution for a product. They hike up prices by a tremendous rate, limit access to the product, and determine which brands are allowed to sell in the state, leaving businesses in the dark and unable to control their own wares.

Private businesses are barred from distributing alcohol in Mississippi. While UberEats, DoorDash, and GrubHub have created thousands of jobs in other states through their delivery systems, our legislative leaders have shut down this opportunity for individuals to order alcohol with their delivery.

And while a variety of companies sell and ship wine, whiskey, and other alcoholic beverages around the country, our legislative leaders have determined that we shouldn’t have this freedom of access.

If you were shopping for a gift online, you might find yourself looking at a wine basket, such as those at Wine & Country. However, upon checkout you will be met with the embarrassing notification that your state is one of only three in the entire nation that completely bars the shipment of any wines.

The excess regulation has made Mississippi last in the nation for craft beer development. For comparison, craft brewers currently produce $150 per capita in Mississippi, while they produce $650 per capita in Vermont. Imagine the difference such an industry could make in our state. This is thousands of tangible new jobs which are being discouraged from coming into existence by our government.

Existing policies have led Mississippi to have the largest shadow economy in the nation (referring to the exchange of products that are not taxed or recorded) at 9.54 percent of GDP. Moonshine is either produced or is available in every single county, which many link to the strict regulation of the alcohol industry. Our egregious taxation of alcohol products displayed here by the Department of Revenue has encouraged many companies such as Costco and Trader Joes to avoid opening locations in the state due to the lack of revenue potential on alcoholic products.

Prohibition is alive and well in Mississippi. Our government has decided we apparently can’t be trusted to make basic purchasing decisions for ourselves, so they must control what alcoholic drinks we’re allowed to have access to, how we’re allowed to receive these drinks, and from whom we’re allowed to purchase these drinks.

Be not fooled by the government “do gooders” who proclaim that they carry out policies like this for our own protection. Too many of our political leaders refuse to give freedom a chance, and instead have decided that they know better than we do when it comes to running our lives.

The fact is that while Mississippi prides itself on having a relatively low income tax, it finds dozens of other ways to tax and control its citizens.

Companies are discouraged from entering into business in the state because we have established covert taxes which discourage entrepreneurial risk taking.

Mississippi controls, regulates, and taxes alcohol worse than New York or California, so imagine what other discrete ways it is shutting down job opportunities and discouraging new business.